Just like the purchase closing process, if you are selling properties in Ontario, you must close the transaction with a lawyer. I will say that if you are familiar with the purchase closing, then the sale closing should not be too foreign for you since you can think of this process as the opposite of the purchase process. I also like to think of sale as defense versus purchase as offense – because you will receive the net proceeds at the very end, the other side, i.e. the purchaser(s), must be satisfied with your property and the deal.

Kindly see below the step-by-step guide in terms of how to close a sale transaction in Ontario:

1. Retain a lawyer or law firm.

Please note that this step is identical to the first step in a purchase closing. So, after you have signed the Agreement of Purchase and Sale (APS), your first order of business should be to find a good real estate lawyer or law firm to represent you for your sale closing.

After you have retained a lawyer, you will be compelled to send them a couple of important documents, including the APS, your personal information, your most recent tax bill, and your marital status.

Your tax bill will be used to first determine how much property taxes you have paid for this fiscal year. Then, your lawyer will calculate how much property taxes you owe for the year, i.e. January 1 until the closing day. So, if you have paid more than you owe, then the net amount that has been over-paid will be included in your net proceeds at the very end. Conversely, if you have paid less than you owe, then the amount owing will be deducted from your net proceeds.

Your marital status is important here because if you have a spouse, then they will affect many parts of the sale closing, including whether they want independent legal advice (if they don’t own the property being sold) and whether they want the net proceeds to be split. Specifically, if your spouse is not on the APS or have ownership of the sale property, they have a right to seek independent legal advice, i.e. legal advice from a lawyer different from yours regarding the deal.

2. Your lawyer requests a payout/discharge statement from your bank.

Please note that this step only applies when you have an existing mortgage that is registered against your sale property that has not been fully paid off.

So, if you do have an existing mortgage, then you must send your latest mortgage statement to your lawyer so that they can request a payout statement (or a discharge statement).

A payout statement is a financial statement generated by the bank that importantly outlines the amount required to fully pay out the existing mortgage on a property. It will also generally note the way in which this amount should be delivered to the bank, such as a wire transfer or a certified cheque. Further, it will show the daily penalty amount in case this payment is delayed.

The process by which your lawyer will request this statement will vary depending on the bank. For example, The Toronto-Dominion Bank (TD) requires that the lawyer fax an official letter reflecting the mortgage number. Conversely, the Bank of Montreal (BMO) wants lawyers to request their payout statement electronically using an online portal.

As far as timing goes, it is ideal if your lawyer receives the payout statement as early as possible before closing day so that they can complete their calculations and importantly let you know how much your net proceeds will be. Please be aware that some banks will send payout statements swiftly, e.g. a month before closing if requested a month prior, but others will send them later, some even sending them on the day of closing.

3. Lawyer receives the letter of requisition from the buyer’s lawyer.

On or before title search date, which is shown on your APS, your lawyer will receive the letter of requisition or the requisition letter from the other side, i.e. the buyer’s lawyer or law firm. A requisition letter is a legal document outlining all the conditions that the buyer’s lawyer wants your lawyer to fulfill by or on closing day. This should be familiar to you if you have looked at my purchase closing guide!

An example of a condition shown on this letter can be that your lawyer fully pays out the existing mortgage on closing day and send proof of this to the buyer’s lawyer. Another example can be that the seller’s lawyer provides the buyer’s lawyer with the lockbox code on closing day when all the closing documents are signed.

This letter is sent by the title search date because along with the requisition letter, the buyer’s lawyer will always send your lawyer title search documents, namely the parcel register. The parcel register is a provincial land document that essentially shows all the title activity on the property, i.e. the change in title or ownership over the years. Title search above means that the buyer’s lawyer will investigate the title of the property – they will then use the results of this to draft their requisition letter.

The lockbox code above will allow the buyer access to the lockbox on the property, where you will have stored the keys. Traditionally, on closing day, your lawyer will send the keys to the buyer’s lawyer, who will then deliver them to the buyer. However, since the pandemic, there has been an increasing trend of the seller leaving keys inside a lockbox and the seller’s lawyer releasing the lockbox code to the buyer’s lawyer on closing.

4. Lawyer submits the response to the requisition letter to the buyer’s lawyer.

After thoroughly perusing the requisition letter, your lawyer will proceed to draft and then submit the response to the requisition letter, or the requisition response, to the other side. You can think of this letter as a point-by-point reply to the requisition letter.

So, an example of a requisition response entry can be that the seller’s lawyer will provide the proof of payment of the existing mortgage to the buyer’s lawyer on closing day. Another example can be that because the seller does not have a lockbox, the keys will be sent to the buyer’s lawyer’s office via courier on closing.

In addition to the letter itself, your lawyer will also send the statement of adjustments as well as the payout statement (if received by then) to the buyer’s lawyer.

The statement of adjustments is a financial statement that shows calculations pertaining to property taxes, condominium/maintenance fees (if the property is a condo), and any utilities that require adjustment.

Do you recall in Step 1 where I explained why your lawyer needs the tax bill? This is the step where the tax bill will work its magic. So, if you have paid more property taxes than you are owed for the year, then this over-payment will be shown as an addition to the net closing proceeds you will receive on closing. Conversely, if you under-paid your taxes, then this amount will be deducted from your proceeds. All this information will be shown on the statement of adjustments that your lawyer will prepare and then send to the buyer’s lawyer, together with the requisition response.

Also, if you are selling a condo, then condo fees will come into play here during the drafting of the statement of adjustments. Condo fees are regular payments that the condo owner pays to management, typically every month, to cover condo maintenance expenses by management.

Now, let’s assume that the condo fees for your unit is $100.00 and your closing day is January 15. Let us also assume that you have paid your condo fees for January on January 1. This means that you have over-paid your condo fees for the month because you are only the owner of the property until January 15. Your over-payment amount will be $50.00 since January 15 is the middle of the month. This over-payment will be reflected on the statement of adjustments.

In terms of the timing of the submission of the requisition response, it is ideal to send it as soon as possible once the requisition letter has been received to prevent delays.

5. Sign closing documents with your lawyer.

After your lawyer has submitted the requisition response and usually a week prior to closing day, you will meet with your lawyer to sign closing documents to be ready for closing.

Some of the documents you will sign will be the draft provincial transfer document, affidavit or statutory declaration regarding ownership, and the waiver of independent legal advice (if you have a spouse, your spouse is not on title or does not own the sale property, and your spouse declines independent legal advice).

Your signing the draft provincial transfer document will acknowledge to your lawyer that they can electronically sign and register the provincial transfer document on closing day, making this transfer of property official.

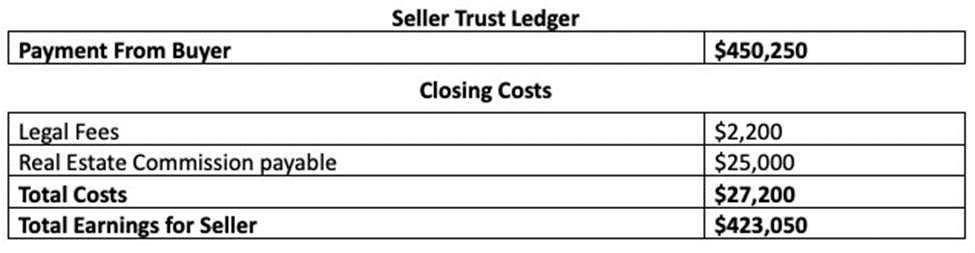

Your lawyer will also go over all the financial documents with you, namely the statement of adjustments, trust ledger, and the mortgage payout statement.

A trust ledger is a financial statement that shows all the expenditures and the money received relating to this transaction. An example of an expenditure can be legal fees paid to your lawyer. An example of money received can be the closing balance received from the buyer’s lawyer. During my time as a legal assistant, a quick glance at a transaction’s trust ledger was enough for me to paint a broad picture of the summary of the transaction.

(Source: https://www.deeded.ca/blog/statement-of-adjustments-and-trust-ledger)

6. Vacate the property on closing day.

We are at the end at last!

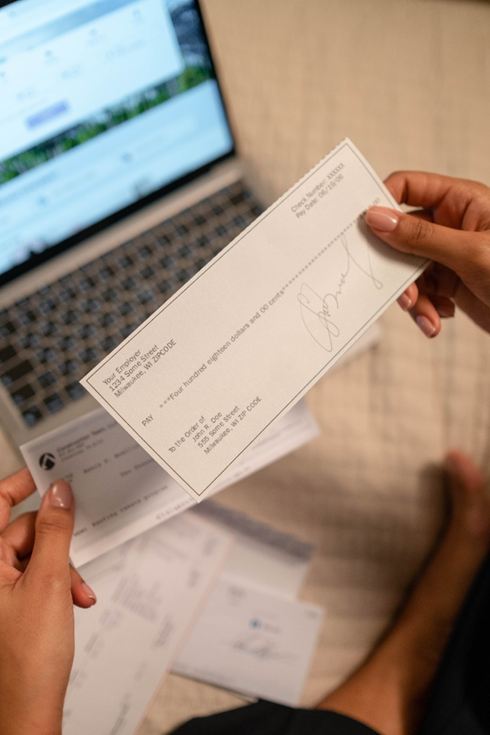

On closing day, your lawyer will begin wrapping up your transaction in earnest as soon as the closing balance has been received from the buyer’s lawyer. Afterwards, your lawyer will first make payment to your bank to fully pay out the existing mortgage (if you have one). Then, your lawyer will work with the buyer’s lawyer to fully sign and register the electronic provincial transfer document. Registration of this document signals the end of the transaction. This means your lawyer will release the lockbox code to the seller’s lawyer. Your lawyer will also cut a cheque to you, which constitutes your net sale closing proceeds.

On your end, be sure to let your lawyer know what the lockbox code is in advance of closing, so that your lawyer can release this to the seller’s lawyer once the deal is complete. Also, you must make sure you fully move out of the property by the end of the day.

This concludes the entire sale closing procedure for the province of Ontario.