In Ontario, you don’t immediately get the keys to your newly bought property once you sign the Agreement of Purchase and Sale (APS). You must retain legal representation, i.e. hire a lawyer or a law firm, for them to walk you through the closing process, after which you will receive the keys and the transfer of the property will be complete.

Below are step-by-step guidelines in terms of the entire purchase closing process, from hiring a lawyer to closing day.

The Steps

1. Retain a lawyer or a law firm for closing.

Before you look for a lawyer or a law firm, you should already have signed the APS, usually with the help of a realtor or a realty brokerage. The APS is a multi-page document that outlines the terms of the purchase (or sale, if you are selling), such as the amount of the downpayment and the closing date.

After you shop around for a lawyer or a law firm, make sure you provide the lawyer or law firm you settled on with the APS so that they are aware of all the basic information required for closing.

Personally, I would choose a lawyer or a law firm that offers reasonable rates and has ample experience doing closings. If their rates are too cheap, they may not spend sufficient resources to make sure your closing is taken care of. Also, I can recall multiple cases where the closing date had to be pushed back, which can be a hassle for everybody involved and can reflect incompetence on the part of the lawyer/law firm handling your closing.

2. Lawyer performs title search of the purchase property.

After you retain a lawyer and send them your APS and basic personal information, the lawyer will conduct a title search of the property. Title here basically means ownership – so, what the lawyer is essentially doing here is that they will look at the history of ownership of the property and see if there are any abnormalities or issues that need to be addressed before closing day.

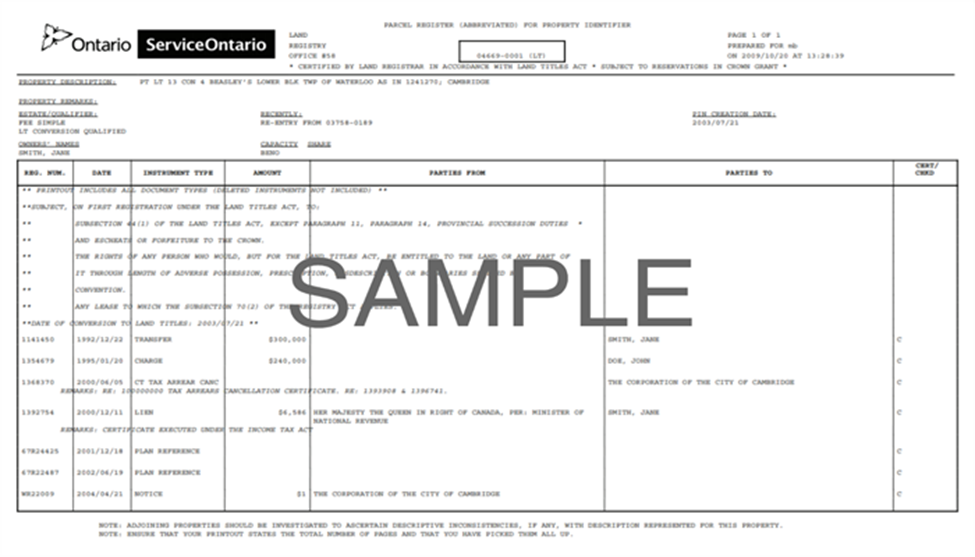

Importantly, your lawyer will access and examine a document called the parcel register, which is also called the PIN. The parcel register will show not only the history of ownership, such as the year in which the previous owner bought the property, but also anything notable that is associated with the property like an existing mortgage.

(Source: https://www.linkedin.com/pulse/how-can-ontario-parcel-register-used-perform-property-sixmar-diaz/)

3. Lawyer prepares and submits letter of requisition to the seller’s lawyer.

After title search is completed, your lawyer will prepare and then send their letter of requisition, or requisition letter, to the seller’s lawyer. The letter of requisition is a legal document that outlines the conditions that your lawyer is requesting, or requisitioning, to the seller’s lawyer for them to fulfill by closing date. An example of these conditions can be that the seller’s lawyer fully pays out the existing mortgage and provide proof of this to the buyer’s lawyer by closing day. Another example can be that if there is a lien on the property, then that this lien be resolved, and the proof of resolution sent to the buyer’s lawyer on closing. A lien is any legal claim that the holder of the lien has over the property – a construction lien is a good example of this. A construction lien may stipulate, for example, that the property owner owes $10,000.00 to the property developer, who holds the lien.

Your lawyer will also conduct a writ search against the seller’s name and send the results to the other side. This search will show any writs of execution that the seller may have – a writ of execution is any court order that shows any debts that the individual named in the writ owe. One important point to note here is that if the seller’s name is common, then any writs of execution that show up may not necessarily be related to the seller. So, part of the due diligence that your lawyer will conduct is to ensure any writs that show are indeed those of the seller, and not a similarly named individual.

Another note here is that there is a title search date shown on the APS – this is the deadline by which the buyer’s lawyer must submit the letter of requisition to the seller’s lawyer. The date is called the ‘title search’ date because the buyer’s lawyer will always include documents related to the title search that they conducted, namely the parcel register.

One final note is that personally, I like to think of preparing and sending the requisition letter as engaging in offense – the ball is in our court, so to speak, because you, the buyer, is obviously providing funds for the property. And because of this, your lawyer is entitled to request certain conditions before the sale is complete.

4. Receive requisition response from the seller’s lawyer.

Generally, after the requisition letter is sent off, your lawyer will receive the response to the requisition letter, or requisition response, a week or so before closing date. This response will outline how each condition noted on the requisition letter is or will be fulfilled. For example, the seller’s lawyer may write that they, indeed, will provide the buyer’s lawyer with the proof of payment to the bank holding the existing mortgage on or before closing.

In addition to the response, they will also usually send your lawyer the latest tax bill and their statement of adjustments. The statement of adjustments will show how much property tax was paid by the seller and how much the buyer will need to pay for the remainder of the year. If the property is a condominium, then this statement will also show how much condominium fee or maintenance fee was paid by the seller and how much the buyer will need to pay for the remainder of the month when the closing day lies.

In contrast to the requisition letter, which I noted was engaging in offense, I like to think of the seller’s lawyer writing and then submitting the response as engaging in defense. Because their client, i.e. the seller, will receive the proceeds from the sale, their lawyer must ensure that all the demands by the buyer’s lawyer is met or will be met by closing.

5. Sign documents with the lawyer.

After the requisition response has been received, your lawyer will begin preparation of your sign-up package, which will include all the documents that must be signed by you and your lawyer so that you will be ready for closing day.

Examples of documents that will be included in this package are transfer of title documents, mortgage documents, and title insurance documents.

A transfer of title, or title transfer, refers to the act of transferring ownership from one individual or corporation to another. So, in the case of your purchase, the title will be transferred from the seller to you, the buyer.

Also, unless you are purchasing the property without a mortgage to finance the deal, which is called a cash deal, you will also sign mortgage documents sent to your lawyer by your bank or mortgage provider. Generally, you will have already signed mortgage documents at the bank with your mortgage broker, so the documents you will sign with the lawyer will usually be in line with those you signed at the bank.

Furthermore, you will sign title insurance documents if your lawyer has ordered the residential owner’s title insurance policy on your behalf. Title insurance is insurance provided by title insurance companies that protects the insured against any title issues, such as title fraud or title defects.

Title fraud can happen like this: Person A finds out that Person B owns a vacation home which is only seasonally occupied. Person A then commits identity theft, working to masquerade as Person B. Via identity theft, Person A goes to a lawyer and illegally transfers title from Person B to Person A. Afterwards, Person A sells this property to a third party, keeping the sale proceeds to themselves.

Because title insurance covers scenarios like the above, it is highly recommended that title insurance be ordered for any purchases made in Ontario. Personally, I do not recall working on a purchase closing where title insurance was not ordered.

6. Receive keys to your new home on closing day.

This is the last step!

Once you sign all the documents with the lawyer, they will prepare for closing day, which is generally a week after all the documents have been signed. One part of this preparation process will be for the lawyer to submit all the signed mortgage documents to the bank and request for their funds on closing day. Another task is for your lawyer to finalize with the seller’s lawyer in terms of how the keys will be delivered. Traditionally, the seller’s lawyer would courier the keys to the buyer’s lawyer, who then will deliver the keys to you directly. However, because of the pandemic, there has been a growing trend of the seller storing the keys for the buyer in a lockbox, with the buyer being notified of the lockbox code on the day of closing.

On closing day, your lawyer will first wait for the mortgage funds to be received to their account. This is assuming that you have already delivered your required funds to the lawyer beforehand (you would generally deliver these funds during the sign-up meeting with your lawyer). After the funds have been received, your lawyer will then send funds due to the seller to the seller’s lawyer – the transfer of funds is usually done via wire transfer or the deposit of certified cheques. Once the seller’s lawyer acknowledges the receipt of said funds, your lawyer and the seller’s lawyer will wrap up the closing process by electronically signing the provincial transfer document that will officially make you the new owner of the property.

Closing Thoughts

The purchase closing process may seem daunting and complicated. However, since the above steps and the basic structure of the process does not change, an experienced lawyer should be able to guide you through the process smoothly and without drama.

I also want to note that the above information has been garnered from my personal experience working at a law firm – they do not constitute legal advice.